Bill C-25, which passed second reading in October, is expected to update legislation that last had an overhaul in 2001. The amendments to the CBCA contained in the bill would modernize Canada’s legal and regulatory framework for nearly 270,000 federally incorporated corporations, though the proposed changes would affect only those that issue stocks and report to a securities commission.

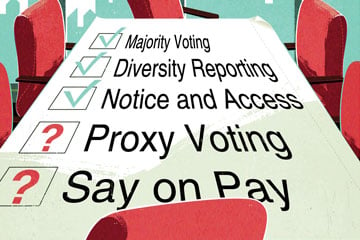

Most of the proposed amendments are not surprising, or radical: mandatory diversity reporting, for one, which is consistent with requirements for TSX-listed companies, and which many companies have already adopted. As well, publicly listed companies would be required to hold annual elections, and elect directors individually rather than by slate voting.

But there’s consternation about others, including a proposed new rule on majority voting. And although the revisions were developed from a call for consultations initiated in 2013, observers say the proposed changes are narrower than what they could have been given the input it received.

“My concerns are more for what’s not there,” says Gary Solway, a partner at Bennett Jones LLP in Toronto. “The diversity reporting, majority voting and other technical amendments are closer to housekeeping than bold new initiatives.”

Of the many submissions the government received, and over a wide variety of topics, “very little is in this act,” he adds. “It kind of feels like . . . an administrative bill as opposed to a bold new direction or massive modernization of our corporate legislation.

“The government has said there’s more to come, and that’s what I think people are waiting for.”

Majority voting

There are “not momentous changes” in the bill, agrees Franziska Ruf of Davies Ward Phillips & Vineberg in Montreal. However, the most significant, she says, is the new majority voting requirement. This would require that votes be cast “for” or “against” individual directors, who must receive a majority of votes in favour of their election when the number of candidates is the same as the number of positions to be filled. Currently, shareholders vote for a director, or withhold their vote; if there were more “withhelds” than “for” votes for a director, “the TSX required that person to tender resignation . . . but the board at least had the ability to consider whether to accept that resignation now, or ever, and for what reasons,” says Ruf. “With the new [proposed] rules, if there’s more ‘against’ than ‘for,’ there’s not much you can do about it.”

Andrew MacDougall, a partner in Osler Hoskin & Harcourt LLP in Toronto, regrets the loss of dialogue that would ensue if the majority voting amendment were to pass. If a director failed to receive a majority of “for” votes, he says, there’s no need for incumbents to submit a resignation, no process for the board to consider the circumstances, or to have a dialogue with investors to find out why a director may have failed to receive the level of support necessary to have been elected.

“And that loss of dialogue is a significant loss, I think, because it precipitated a conversation that needs to happen between boards and shareholders,” says MacDougall. “With the [proposed] election standard … there’s no debate, there’s no discussion, there’s no feedback as part of that process.”

There’s a material difference between majority voting as currently applied by TSX-listed issuers, and the standard that is being proposed under the CBCA, he says, “I don’t think the majority voting standard as proposed in the legislation works.”

Ruf also fears that, because the proposed majority voting rules read differently than TSX rules, “what do we comply with? Presumably, the more stringent one,” which would be the CBCA rule. But if companies can rely on their own exchange’s rules — for example, the Toronto Stock Exchange’s requirements — she worries it could lead to jurisdiction shopping.

Also, she says, “I really see . . . the majority voting/risk of failed director election as being the main risk at this stage.”

Diversity reporting

Under Bill C-25, reporting issuers will be required to provide to their shareholders information concerning the composition of their boards of directors and senior management by sex, and disclose any diversity policies or explain why none are in place.

Ruf notes that “there’s no real meat” around what the government is proposing in the CBCA. “The details will be in the regulations, which don’t exist yet.” More likely than not, she says, the government will go with something very similar to what the most of the provincial securities commissions require with respect to diversity, meaning it won’t be mandatory or carry quotas.

Minister of Innovation Navdeep Bains, sponsor of Bill C-25, has said his government may consider targets if there is no improvement to diversity on corporate boards in the next few years. A report issued in June by Catalyst, a non-profit organization that promotes inclusive workplaces for women, found that in 2014 women filled just 20.8 per cent of director positions at publicly traded Canadian companies. Catalyst has called for targets in order to improve those numbers.

The Ontario Securities Commission and others “have rules that you have to comply or explain diversity on your board,” says Ruf. “It sounds like that’s largely where the feds will go on the CBCA as well.” The OSC has considered models in other parts of the world, she says, including Europe, which has quotas, and it has shown results because there is no choice but to comply. “But the [Canadian] government is saying, ‘let’s try to let the market and peer pressure do its work.’ “

Companies are making serious, concrete efforts to do something about it, she adds, though, “I don’t think anyone wants mandatory quotas. It’s nice to have half women on a board, but what if there aren’t that many qualified women” to elect?

‘Notice and access’

The CBCA’s requirements for paper-based communications will be replaced with a “notice and access” system, which would allow corporations to use electronic communications to provide notice of shareholder meetings.

Ruf calls the notice and access provision welcome, though MacDougall is concerned with the wording of the amendment. He says, “The legislative change is to allow the director to grant an exemption on any terms that she might think fit on annual meeting delivery requirements, whereas the statute should provide authority to prescribe by regulation that if you’re complying with notice and access under securities laws, there should be absolutely no need to apply for relief under the corporate statute.”

MacDougall also notes that a director’s authority to grant exemptions from annual shareholder delivery requirements does not extend to the proposed new diversity disclosure requirement. Diversity disclosure must be provided “along with” the notice of meeting, he says. Under the amendments, the director can exempt corporations from sending the notice of meeting to shareholders, but he or she cannot exempt the corporation from providing shareholders with the diversity disclosure required under the new section 172.1.

What’s been left out of Bill C-25

One suggestion the federal government received, says MacDougall, was “say on pay.” The Canadian Coalition for Good Governance suggested a non-binding vote in which annual shareholders would have a right to say whether they supported executive compensation as described in the company’s circular.

“There’s no proposed change here.” Another suggestion was to require separation of the CEO and chairperson roles, though most large public companies in Canada have already done so, he says: It’s something that differentiates Canada from the United States.

And should shareholders of public companies be required to vote in person? Most vote by proxy, says Ruf, and “there’s no way to cross-check how many shares that person represents.” An even more interesting issue, she says, is that of empty voting and over-voting, which she calls “the proxy plumbing system.”

In a public company, many shareholders hold shares through a stockbroker, she says, who holds them through the Canadian Depository for Securities. “So, it’s hard to know whether a person who shows up at a meeting by proxy is . . . actually the holder of the shares or has leant shares. . . . Is a vote still in their hands? That’s empty voting, when you have no economic risk at stake.”

Over-voting is when shares may have been transferred or lent before or after a record date and two people end up voting. “That’s been an ongoing process that Canadian securities administrators have been looking at for years, but [it] was raised for comment in 2014 for the CBCA,” says Ruf. “Maybe they want to let securities regulators deal with it. They’re completely silent on that now.”

What’s next

It could be upwards of a year before the bill becomes law, MacDougall predicts.

“It’s got another couple of seasons in House, and has to go through Senate,” says Ruf.

The Liberal government is in majority in both houses, she notes, and she wonders if the government will have sufficient concern about failed director elections caused by the proposed majority voting rule. “The rest will be the meat they put into the regulations, and which we haven’t seen yet. That will give us more guidance as to the circumstances, which count as exceptional.”